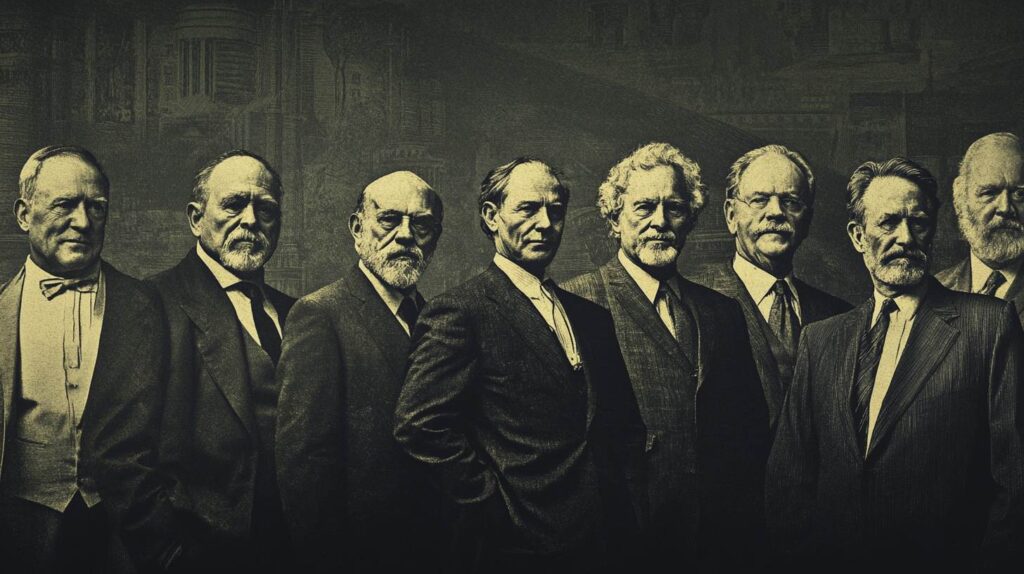

Trading has long been a profession that captivates the minds of those seeking wealth, independence, and the thrill of financial markets. From the earliest days of barter systems to the sophisticated algorithms that power today’s financial transactions, trading has evolved dramatically, reflecting broader economic, technological, and societal changes. Picture a bustling marketplace thousands of years ago, where the first traders exchanged goods, laying the foundations for the intricate global trading systems we now rely on. Fast forward to the present, and platforms like Argoox are leading the way, utilizing AI to navigate the complicated and volatile world of cryptocurrency markets. This article delves into the evolution of trading, highlighting the pioneers and famous traders who set the stage for modern practices and exploring the strategies of legendary traders who have left an indelible mark on financial history.

Overview of Trading as a Profession

Trading, as a profession, has always been a blend of art and science. It requires not only a deep understanding of markets but also the ability to manage emotions, adapt to changing conditions, and continuously learn from successes and failures. The profession has attracted a wide range of individuals, from those driven by the thrill of speculation to others focused on the methodical analysis of data. Over time, trading has transitioned from being an activity reserved for the wealthy to one accessible to anyone with just a computer and an internet connection. Despite these changes, the core of trading—making informed decisions to buy and sell assets—remains the same.

Pioneers of Trading

The evolution of trading practices is crediting to several early pioneers who established principles that still resonate today. These traders, often operating in unregulated and volatile markets, laid the foundation for what would become a complex and highly regulated industry.

- Phoenician Traders: As the first known traders, the Phoenicians were instrumental in developing the rudiments of international trade, establishing sea routes, and introducing written contracts.

- Medieval Merchants: In medieval Europe, merchants became the new pioneers of trading, forming guilds and developing early forms of banking and credit systems that allowed for greater trade efficiency.

- Dutch East India Company: The 17th century saw the rise of the Dutch East India Company, often considered the first multinational corporation. In fact, it played an important role in shaping modern corporate structures and stock exchanges.

Legendary and Famous Traders of the 20th Century

Jesse Livermore

Known as the “Great Bear of Wall Street,” Jesse Livermore in one on the biggest and most famous traders was a pioneering stock trader who made and lost multiple fortunes during his career. His trading strategies, particularly his ability to short-sell during market downturns, are still studied today.

Paul Tudor Jones

Paul Tudor Jones has gained his fame for predicting the 1987 stock market crash and profiting massively from it. His approach to trading, also combines macroeconomic analysis with technical indicators, set the stage for hedge fund management in the latter half of the 20th century.

George Soros

Perhaps best known for “breaking the Bank of England,” George Soros is a legendary currency trader whose hedge fund returns are among the highest in history. His focus on global macroeconomic trends and political events has made him a towering figure in finance.

Warren Buffett

Dubbed the “Oracle of Omaha,” Warren Buffett is known as one of the most famous traders and widely regarded as one of the most successful investors of all time. Moreover, His value investing strategy, which involves buying undervalued businesses or companies and holding them for the long term, has proven highly effective.

Richard Dennis

Richard Dennis, who became famous trader as the “Prince of the Pit” . He was a commodities trader who, along with his partner William Eckhardt, trained a group of novice traders known as the “Turtles.” His experiment proved that trading could be taught, and his methods are still used in futures trading today.

Modern-Day Trading Titans

As we move into the 21st century, new trading titans have emerged, leveraging technology and innovative strategies to dominate the markets. Here are famous traders of modern day trading:

Ray Dalio: The Bridgewater Visionary

Ray Dalio, founder of Bridgewater Associates, is renowned for his “Pure Alpha” strategy and principles-based approach to life and investing. His firm is the largest hedge fund in the world, known for its rigorous analysis and innovative investment strategies.

Jim Simons: The Quant King

Jim Simons, a mathematician turned trader, founded Renaissance Technologies, a firm known for its use of quantitative models to execute trades. His Medallion Fund has achieved unparalleled returns, making him one of history’s most successful hedge fund managers.

Carl Icahn: The Corporate Raider

Carl Icahn made his name as a corporate raider in the 1980s, buying stakes in companies and pushing for modifications to unlock shareholder value. Consider that his aggressive strategies have made him a feared and respected figure in the world of corporate finance.

David Tepper: The Contrarian Investor

David Tepper, founder of Appaloosa Management, is known for his contrarian bets, often buying distressed assets during economic downturns. His bold moves during the 2008 financial crisis earned him significant returns and cemented his reputation as a savvy investor.

Stanley Druckenmiller: The Macro Maestro

Stanley Druckenmiller, who managed money for George Soros, is renowned for his ability to predict macroeconomic trends and place large, profitable bets. His long-term track record is one of the best in the hedge fund industry.

Lessons Learned from Famous Traders

The stories of these traders offer invaluable lessons for anyone looking to succeed in the markets.

Common Traits of Successful Traders

Successful traders often share common traits such as discipline, patience, and the capability to manage risk. They are also highly adaptable, constantly learning from their experiences and adjusting their strategies as markets evolve.

Trading Strategies That Made Them Famous

Each of the traders mentioned has employed specific strategies that contributed to their success. For example, Livermore’s short-selling tactics, Soros’s global macro trading, and Buffett’s value investing have all become legendary in their own right.

The Importance of Psychology in Trading

The mental aspect of trading is critical. Many of these traders have emphasized the importance of maintaining a calm and disciplined mindset, especially during market volatility. Understanding one’s psychology and managing emotions can be the difference between conquest and failure in trading.

Controversial Traders and Their Legacies

Nick Leeson: The Rogue Trader

Nick Leeson was a derivatives trader whose unauthorized trades caused Barings Bank to collapse in 1995. His story is an exemplary tale about the dangers of insufficient oversight and the potential consequences of excessive risk-taking.

Bernard Madoff: The Ponzi Scheme Mastermind

Bernard Madoff is known for running the largest Ponzi scheme in history. He defrauded investors out of billions of dollars. His downfall highlighted the importance of due diligence and the risks of blindly trusting financial advisors.

Jordan Belfort: The Wolf of Wall Street

Jordan Belfort, whose life was immortalized in the movie “The Wolf of Wall Street,” was a stockbroker who engaged in illegal activities, including securities fraud and money laundering. In fact his story is a reminder of the ethical responsibilities that come with trading.

Influence of Technology on Trading

Technology has revolutionized trading, introducing new tools and techniques that have transformed the markets.

The Rise of Algorithmic Trading

Algorithmic trading uses computer programs to execute trades at speeds and frequencies impossible for human traders. This has led to increased market efficiency but also raised concerns about market stability and the potential for flash crashes.

Crypto Trading Bots

In the cryptocurrency market, AI and machine learning-based trading bots like Argoox have become increasingly popular. Also, these bots analyze vast amounts of data to execute trades with precision, offering users an automated way to navigate the highly volatile crypto markets.

High-Frequency Trading and Its Impact

High-frequency trading (HFT) involves executing a large number of orders at extremely high speeds. While HFT has brought liquidity to the markets, it has also been criticized for contributing to market volatility and creating an uneven playing field.

The Role of Social Media and Retail Traders

The rise of social media has democratized information, allowing retail traders to band together and influence market movements. The GameStop saga in early 2021 is a prime example of how collective action on platforms like Reddit can disrupt traditional trading norms.

Conclusion

The world of trading is as complex as it is fascinating, shaped by the visionaries who have mastered its intricacies and the controversies that have highlighted its risks. From the early pioneers to the modern-day titans and famous traders, the evolution of trading is a testament to human ingenuity and the relentless pursuit of profit. In fact, as technology continues to transform the markets, tools like Argoox’s AI trading bots are becoming indispensable for navigating the challenges of the financial and cryptocurrency markets. Whether you’re just starting a trade as a beginner or a seasoned trader, learning from the past and embracing the innovations of the present can help you succeed in this ever-evolving field. Visit Argoox today to discover how AI can enhance your trading strategy and take your investments to the next level.