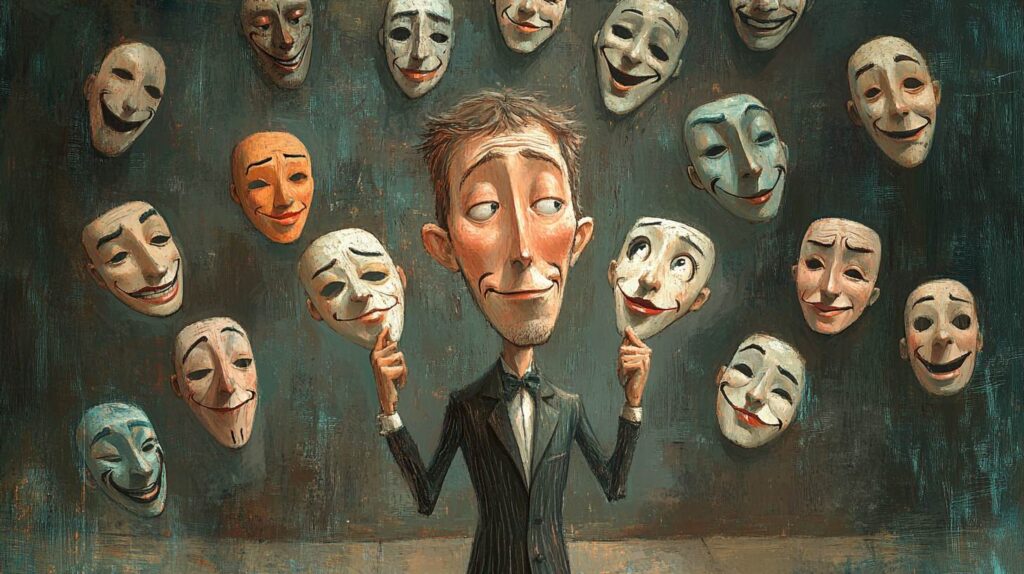

Human bias and emotion play significant roles in cryptocurrency markets, impacting decision-making and trading behaviors. These psychological factors can lead to irrational decisions, influencing market trends and individual portfolios.

Definition, Meaning, and Example of Human Bias and Emotion in Crypto

Human bias refers to the systematic pattern of variation from norm or rationality in judgment, where individuals make their own “subjective reality” from their perception of the input. In the context of crypto, biases like confirmation bias, overconfidence, and herd behavior can lead investors to make decisions that aren’t based on sound analysis. For example, an investor might believe strongly in the future success of Bitcoin and thus disregard any negative news or analysis about it (confirmation bias).

Emotion in trading encompasses feelings such as fear, greed, and excitement. These emotions can drive irrational trading behavior. For instance, during a sudden price increase (a bull market), greed can lead to over-trading or buying at high prices, hoping for further gains. Conversely, during a market drop, fear can result in panic selling, often at a loss. An example is the 2017 Bitcoin bull run, where many investors bought Bitcoin at its peak out of FOMO (fear of missing out) and then sold at a loss during the subsequent crash.

How Do Human Bias and Emotion Work in Trading Crypto?

In crypto trading, human bias and emotion can manifest in various ways. Cognitive biases like confirmation bias cause traders to seek information that supports their existing thoughts, ignoring contradictory evidence. Emotional responses can lead to impulsive decisions, such as panic selling during a market dip or exuberant buying during a rally. This behavior often leads to suboptimal trading results, reinforcing the need for a disciplined approach to investing.

Benefits and Disadvantages of Human Bias and Emotion in Crypto Trading

Benefits:

- Quick Decision-Making: Emotional responses can sometimes facilitate rapid decisions, which is crucial in the highly volatile crypto markets.

- Market Sentiment Analysis: Understanding common biases and emotions can help traders predict market movements and sentiment, potentially leading to profitable opportunities.

Disadvantages:

- Irrational Decisions: Biases and emotions often lead to decisions not grounded in objective analysis, resulting in poor investment choices.

- Increased Risk Exposure: Overconfidence and herd mentality can push traders to take on excessive risks, potentially leading to significant losses.

- Market Volatility: Collective emotional responses can amplify market volatility, as seen during crypto bubbles and crashes.

- Emotional Exhaustion: Constantly dealing with the emotional highs and lows of crypto trading can lead to burnout and stress, affecting overall well-being and decision-making abilities.

How Can Human Bias and Emotion Affect Trading?

Human bias and emotion can significantly affect trading outcomes. For instance, overconfidence bias may lead traders to overestimate their knowledge and take on excessive risk. Loss aversion can cause individuals to hold onto losing acquisitions for too long, hoping to recoup losses. These behaviors can distort market prices and lead to irrational trading patterns, highlighting the importance of emotional regulation and cognitive awareness in successful trading.

What Are Common Human Bias and Emotions?

Several common biases and emotions affect crypto traders. These include:

- Confirmation Bias: Looking for information that confirms preexisting beliefs.

- Overconfidence Bias: Overestimating one’s knowledge and abilities.

- Loss Aversion: Favoring to avoid losses rather than achieving gains.

- Herd Mentality: Following the actions of the majority, often leading to bubbles or crashes.

- Fear and Greed: Driving impulsive buying or selling decisions based on market movements.

Strategies to Overcome Emotional Biases in Investing

Education and Research: Continuously educating oneself about market trends, trading strategies, and the psychological aspects of trading can reduce reliance on emotions. Staying informed helps in making more rational decisions based on solid analysis rather than speculation.

Diversification: Spreading investments across various assets can mitigate risks associated with emotional decision-making. Diversification ensures that not all investments are affected by a single market event, reducing the impact of emotional trading.

Setting Clear Goals and Limits:

- Investment Goals: Define clear long-term objectives and stick to them. Having a well-thought-out investment plan can prevent impulsive decisions driven by short-term market movements.

- Stop-Loss Orders: Setting predefined stop-loss orders can help automatically sell digital assets when they reach a certain price, limit losses, and remove emotional interference.

Automated Trading: Utilizing automated trading systems or algorithms can help execute trades based on pre-set criteria, removing emotional bias from the decision-making process. These systems can act swiftly and consistently, adhering strictly to the strategy without getting swayed by market emotions.

Mindfulness and Stress Management: Practicing mindfulness, meditation, or other stress management techniques can help maintain emotional balance. Staying calm and composed during market volatility is crucial for making rational decisions.

Seeking Professional Advice: Consulting with financial advisors or using reliable trading platforms with built-in risk management tools can provide additional layers of guidance and control, helping to keep emotional biases in check.