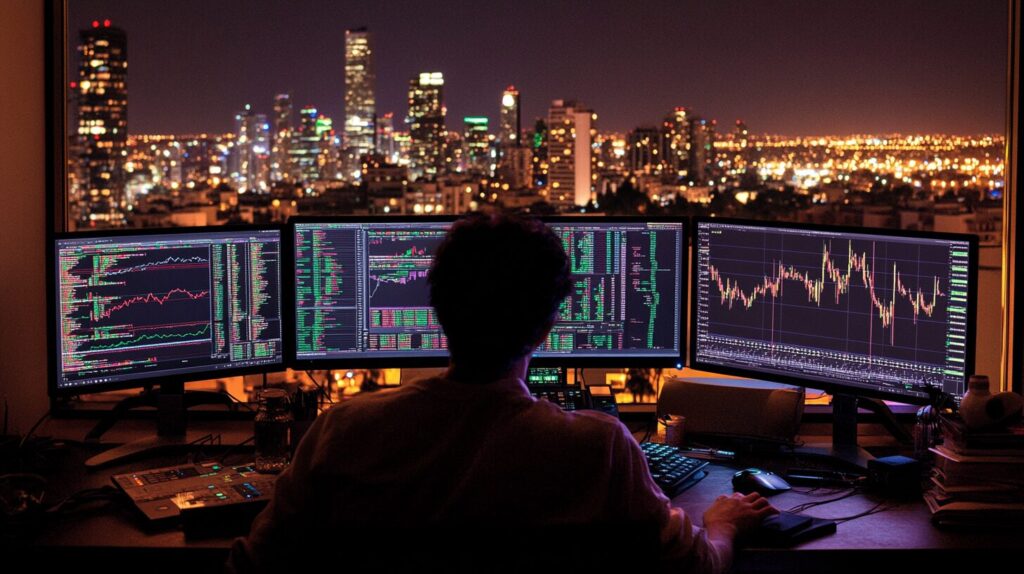

What is Margin Trading in Crypto?

Margin trading in the crypto context involves borrowing funds to trade digital assets, which can amplify both potential profits and losses. This trading method allows

Margin trading in the crypto context involves borrowing funds to trade digital assets, which can amplify both potential profits and losses. This trading method allows

Market maker has a critical role in the cryptocurrency markets by providing liquidity and stability, which helps keep trading efficient. They act as intermediaries, facilitating

Machine learning, short ML, is revolutionizing various industries, and the cryptocurrency market is no exception. As a subset of artificial intelligence, ML involves using algorithms

Market fundamental or fundamental value in cryptocurrency refers to the intrinsic worth of a digital asset, determined by factors beyond just price fluctuations. Technical analysis

Longing crypto refers to the strategy of purchasing cryptocurrency with the expectation that its value will rise over time. This approach is common among traders

Long-term reversal in the cryptocurrency market refer to the price trends where a prolonged decline is followed by a significant and sustained recovery, or vice

Long-term investor in cryptocurrency focus on holding assets over an extended period, often years, to benefit from potential appreciation in value. Unlike traders who seek

Liquidity pools are a cornerstone of the decentralized finance (DeFi) ecosystem, enabling seamless trading and access to liquidity for various cryptocurrencies. These pools are integral

Institutional investors are prominent players in the financial markets, and their entry into the cryptocurrency space marks a significant shift in the industry’s dynamics. These

Insider trading in cryptocurrency involves trading digital assets based on non-public information. This practice can influence market prices and give unfair advantages to those with

Inflation in cryptocurrency is a crucial topic for understanding the financial dynamics of digital assets. Unlike traditional currencies, cryptocurrencies operate on decentralized platforms, and inflation

Human bias and emotion play significant roles in cryptocurrency markets, impacting decision-making and trading behaviors. These psychological factors can lead to irrational decisions, influencing market